Autumn brings more than crimson leaves, pumpkin spice lattes, and the resurgence of candy corn on the shelves of your local corner store. The start of fall is also a glaring reminder that proxy voting guideline season is upon us.

ISS and Glass Lewis

Institutional Shareholder Services (“ISS”), an influential shareholder advisory firm that conducts research on publicly-traded companies and uses specific voting guidelines to make voting recommendations for companies, begins each proxy voting guideline season by launching its annual Global Policy Survey, which is comprised of two specific surveys:

- ISS Governance Policies Survey: Covers high-profile governance topics in the areas of auditors and audit committees, director accountability, board gender diversity and the “one-share, one-vote” principle that apply globally. This survey closed on August 24th.

- ISS Policy Application Survey: Covers a more expansive and detailed set of questions, broken down by region. This allows respondents to drill down into many specific voting issues across the Americas, EMEA, and Asia-Pacific. This survey closed on September 21st.

In addition to these two surveys, ISS also conducts a variety of regionally-based round-tables and conference calls to gather broad input from investors, company executives, directors and other organizations. It uses the data collected to make updates and develop its benchmark proxy voting guidelines for the upcoming year and beyond.

Draft guidelines are then sent out by ISS for public comment during the fall with the final published guidelines released in November of each year for annual general meetings occurring after February 1st of the following year.

Glass Lewis is another example of an influential shareholder advisory firm that assists in proxy voting guidelines season. It prefers to take a more private approach when developing these guidelines throughout the year and only releases a final, up-to-date, version in November of each year.

Both organizations have a significant impact on the voting results at Annual General Meetings (“AGMs”) for publicly-traded companies as over the past decade or so, many institutional shareholders have relied on the research of both ISS and Glass Lewis in order to decide on important voting matters such as:

- Annual Election of Directors

- Annual Advisory Vote on Executive Compensation (“Say on Pay”)

- Vote on Frequency of Advisory Vote on Executive Compensation (“Say on Frequency”)

- Vote on Golden Parachutes

- Approval of Equity Incentive Plans

- Annual Approval of Auditors and their Fees

- Mergers & Acquisitions

- Shareholder Rights & Defenses

- Separation of Chairman and CEO Roles

- Environmental & Social Factors

In past years, a lot of institutional shareholders would rely not only on the research, but also the voting recommendations of ISS and Glass Lewis to vote their shares at each company’s AGM. However, in recent years organizations such as Blackrock, Vanguard, JP Morgan, Ontario Teachers’ Pension Plan and many more have started to develop their own proxy voting guidelines. While these guidelines tend to align with ISS and Glass Lewis, each institutional shareholder has developed their own nuanced approach to voting their shares. Institutional shareholders will also use these voting guidelines to conduct engagement with specific companies to try to influence change in areas where a company’s current approach does not align with their views.

With this in mind, it is important for publicly-traded companies to understand the proxy voting guidelines not just of ISS and Glass Lewis, but also those of its largest institutional shareholders. By better understanding the views of these groups, a company can look for areas that are currently mis-aligned with the guidelines. The company can then determine whether changes should be made to align with the guidelines of its major shareholders or whether there are valid reasons for not aligning to the guidelines and be able to defend why the company’s approach is in the best interest of shareholders.

A thorough understanding of proxy voting guidelines also allows companies to model and stress test how current equity plan designs, executive compensation and corporate performance levels will fare when tested under ISS and/or Glass Lewis research and stress tests.

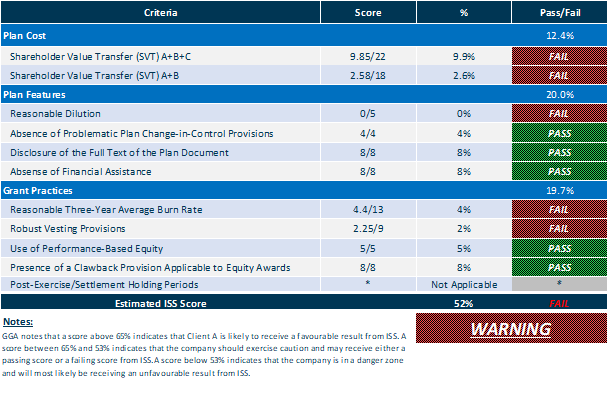

At Global Governance Advisors (GGA), we often are asked by our Board clients if their current Stock Option Plan or Restricted Share Unit Plan that is up for shareholder approval at the next AGM will pass the ISS Equity Plan Scorecard test. Over the years, we at GGA have done extensive work in this area and have created a proprietary Equity Plan Scorecard Modeller (see example below) that seeks to estimate how a plan will stack up against ISS criteria. The Modeller allows our clients to work with us to enter in the parameters of its current equity compensation plan up for approval in each of the areas assessed by ISS and our proprietary model will provide an estimate of whether the plan design will “Pass” or “Fail” the test ahead of time. While GGA cannot guarantee the results will be exactly the same as the ISS results, the Modeller provides clients with a sense of their chances of receiving a “Fail” result. GGA can then work with the client to make amendments to the current plan design that will increase the likelihood of a more positive “Pass” result when the actual ISS test is conducted in advance of its AGM.

Illustrative Example: Equity Plan Scorecard Simulator

ISS also runs an annual Pay-for-Performance Test, which it uses when making voting recommendations on a company’s Say on Pay vote on executive compensation. This test covers:

- Relative Degree of Alignment;

- Multiple of Median; and

- Financial Performance.

Understanding how each of these tests is conducted allows companies to get out ahead of the curve and work with its compensation advisor to test the current compensation levels and performance prospectively in advance of the ISS analysis. At GGA, we have also created proprietary tools to estimate the results of ISS’ Pay-for-Performance tests that we use with our clients as an estimate of ISS results. Based on the results of this analysis, we can then work with our clients to improve their chances of receiving a “Yes” recommendation for their Say on Pay vote and to improve their annual Compensation Discussion & Analysis disclosure to provide appropriate rationale for why compensation levels have been set the way they have.

Closing Thoughts

Proxy voting guideline season is upon us. Be on the lookout for ISS and Glass Lewis draft proxy voting guidelines for 2019, which will be coming out in the next few weeks. ISS will provide a window for companies to comment on the proposed 2019 guidelines, so be sure to review any updates to their policies and any of their existing guidelines and consider providing feedback. After this comment period ISS will take into account any feedback received and finalize its guidelines, so look for their finalized 2019 proxy voting guidelines which will most likely be published in November of this year. Understand how your current compensation plans and governance practices align with ISS and Glass Lewis guidelines, but also those of your major shareholders so you can prepare in advance of your 2019 AGM. Work with your compensation advisor to review any discrepancies between your current practices and the guidelines and be prepared to test whether your policies will “Pass” or “Fail” ISS, Glass Lewis and major shareholder assessments. Ultimately, understanding proxy voting guidelines will allow companies to get out ahead of the curve and prevent negative vote outcomes during the 2019 proxy season.

Like what you read? Feel free to browse through the rest of our blog site (how about checking out Four Steps a Board Should Follow When Determining Executive Compensation) for more information.