2020 Executive Compensation Amid Market Uncertainty

Effects of COVID-19 on Executive Compensation

With a global pandemic upon us, the world is a very different place, at least right now. However, just like there is no need to hoard cans of tuna and cases of toilet paper, we at GGA believe that it is not advisable at this juncture, to call off your organization’s executive compensation program plans for 2020. In fact, it is times like these that corporate governance, risk management, technology and innovation and board oversight are imperative to preserving shareholder value, while also and most importantly ensuring the health and safety of our employees.

What we know from other market crises, is that corporate governance and executive retention are high on the list when navigating black-swan events. If there ever was a black-swan event, COVID-19 may have now assumed the definition.

We suggest that as long as the Board and/or the CEO maintains the ability to use their judgment on implementation timing, eligibility, etc., for example, then plans should proceed. There are obvious exceptions to this where an organization may not have the available cash flow due to this ‘black swan’ event (e.g. airlines, tourism companies, etc.).

In the interest of brevity, this piece is meant to cover only high level corporate governance and retaining key talent, but we understand that there are broader considerations when factoring in an organization’s complete workforce as many companies may have to layoff some of their staff due to decreased demand for their products/services and the corresponding decrease in cash flow for the business (as we write this a number of immediate family members and friends have already been impacted directly). While we cannot predict the future, we at GGA can share our observations within the marketplace and areas for consideration as boards make decisions over the next few months relating to corporate governance and executive compensation. So far, within the mining and broader commodity businesses, we have seen some proposed delays in work or a cautious movement forward, as planned.

Areas for consideration during these difficult times include:

Board Oversight

Businesses are continuing to try to make the best of a bad situation and effective corporate governance needs to continue, within reason, in the same spirit, to ensure effective oversight of the organization. How easily is your board able to meet remotely as opposed to in-person? What decisions can be made via consent resolutions versus requiring a full meeting? Have you stress tested the impact of black swan events on your company’s operations? What plan do you have in place to deal with black swan events in a crisis and who is responsible for what?

Retention of Key Talent

Strategies for attraction and retention of executive talent are critical as even in immediately affected companies, the demands on executive teams are typically extremely high, more so than in normal market conditions, to chart out a path forward. If your board has observed a gap to market from a pay perspective, how are you going to let your executive team know that you recognize this gap, but also are taking into account the current market conditions? Some organizations will choose to “stay the course” and implement any compensation adjustments that were determined at the past meeting. Others may choose a more conservative route and announce salary freezes or even rollbacks, depending on the cash flow concerns of the business. A good middle ground might be to approve compensation adjustments in principle but hold off on formally enacting the adjustments for a few months until market conditions have stabilized and better financial projections can be made. In terms of Long-Term Incentive (LTIP) grants, previous grants may have been made at significantly higher share prices so you must also consider what value, if any, executives still have within their LTIP and what the prospects are for this value to rise over the next few months or even years. If you are only granting Stock Options, is there a chance for underwater options to get back in-the-money or is the probability low? If the probability is low, then executives are a flight risk as competitors will be able to offer them new LTIP grants at significantly lower exercise prices than if they stay with your organization. This may necessitate discussion on the need for new retention grants which can be made at a lower share price and increase the likelihood of long-term value to executives, thus acting as a retention device during this period.

Retention Strategy

While retention LTIP awards seem like a good idea in the current environment, these awards must be balanced with the equity dilution level of the organization under its existing equity compensation plans. At lower share prices, the level of equity dilution can increase dramatically and use up much needed room for LTIP grants in the future. In a time like this, stress testing of the impact on equity dilution levels of proposed grants is an important step that boards must conduct before approving regular or retention-based LTIP grants. If proposed grants are too dilutive then consideration of a fixed number of options or units to be granted, that will allow an organization to retain room for future grants, is something that should be considered in the interim until market conditions stabilize. For many organizations, dilution will also not support additional retention awards, so a board may need to consider a performance cash based award, that is granted outside of the shareholder approved equity plan. At all costs, while option surrender programs continue to be allowed by the regulator, categorically shareholder advisory firms consider this an option re-pricing problematic pay practice.

Performance Evaluation

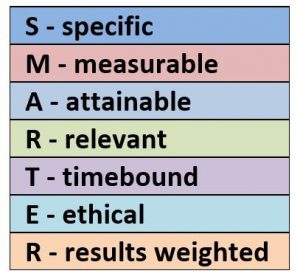

If performance expectations under the Annual Balanced Scorecard have already been approved, the Board should evaluate the performance expectations set and determine whether those expectations are still reasonable in the ever-evolving environment. If expectations are now deemed to be unreasonable in the Board’s view, consideration of revised performance targets based on the new reality should be discussed to ensure executives are still motivated to achieve important objectives over the remainder of the year.

Remember that while retaining key talent is imperative and in shareholders long-term interests, the board must also give consideration to the shareholders who have potentially lost material amounts of their portfolio. These executives are tasked with not only mitigating the financial blow in the downward market, but also to generate value when markets return. Ensure your board is not making compensation decisions in a vacuum during these challenging times. Seek the independent support necessary to give appropriate back testing and scenario analysis prior to making any potential retention decisions.

Contributing Authors:

Paul Gryglewicz, Senior Partner

Arden Dalik, Senior Partner

Peter Landers, Partner