Establishing Compensation Programs for Growth in the Cannabis Industry

Don’t let this opportunity go up in smoke!

It has been two eventful years since the Canadian federal government announced its plans to pass legislation to legalize the recreational use of marijuana. In the U.S., over 80% of the states including California, Colorado, Oregon and Washington have legalized recreational and/or medicinal use of marijuana at the state level. The California industry alone is projected to hit over $7 billion in a few years. This has led to a growing list of emerging companies in the cannabis space seeking financing through the public markets as they see the opportunity in building up their operations to cater to a significant spike in marijuana use now that it is legalized in Canada and more and more U.S. states are legalizing it in some form or fashion. While listing on exchanges in the United States can still be problematic due to the current U.S. federal ban, Canadian stock exchanges have provided a reputable market for cannabis shares with companies listing on the TSX Venture Exchange and Canadian Securities Exchange (CSE). Certain Canadian listed companies have also been able to dual-list their shares on the NYSE such as Canopy Growth, Aurora Cannabis and Aphria with others such as CannTrust currently in the process of listing in New York. This is providing greater exposure of these stocks to institutional investors and index funds.

This shifting dynamic creates a great opportunity for companies throughout the value chain of the cannabis industry such as research and developers, producers, processors, distributors, wholesalers and retailers to realize significant growth through first mover advantages. However, it also requires that the Boards of Directors of these companies put in place the proper executive compensation structures to attract, retain and motivate its executives to execute on the overall business strategy. Companies must also be aware of the various rules and regulations that come with being a publicly-traded company. For those companies graduating up to major exchanges such as the TSX, greater scrutiny from institutional investors and proxy advisory firms such as Institutional Shareholder Services (ISS) and Glass Lewis on compensation levels and designs can also be expected. With this in mind, here are the top areas boards of publicly-listed and privately-held companies across the spectrum of the cannabis industry must consider when dealing with executive compensation matters as they continue to navigate this exciting time of expansion in 2019.

Top Area of Focus for Executive Compensation

- Compensation Philosophy & Peer Group

- Executive Compensation Levels

- Short-Term Incentive Design

- Equity Compensation & Related Documentation

- Employment Agreements

- Shareholder Engagement

Compensation Philosophy & Peer Group

A company’s executive compensation philosophy establishes the foundation for its compensation program as it outlines the objectives of the program and the types of compensation to be offered. It also outlines the peer group that will be used to benchmark compensation levels and practices as well as a company’s desired positioning when compared to that peer group. For companies in a rapid growth phase, peers that might have been comparable a year ago from a size and strategic perspective may have become obsolete due to their size or through acquisitions. The peer group for a $100 million market cap company will look a lot different than a $1 billion company! A good rule of thumb is to look for a peer group of companies within 0.5x to 2x the current size of your organization. Then consider other characteristics such as business model, location of operations, product offerings as well as who you would look to recruit from, or who you might lose talent to, within the marketplace. This could include not only cannabis industry peers, but also other pharmaceutical or fast-moving consumer goods companies in regulated industries such as alcohol and tobacco. Companies in high growth mode will also be looking to attract key talent to drive this growth, which may require a philosophy that targets compensation levels closer to the 75th percentile as opposed to the typical peer group median.

Executive Compensation Levels

In the early stages of a business, there tends to be less concern over compensation levels as the majority of compensation is tied to equity compensation that is intended to provide a windfall if and when future share price growth is achieved. As a company matures, the need to attract and retain key talent becomes paramount and requires a better understanding of the compensation provided to similar professionals in a competitive market. In stages of rapid growth and the resulting change of peers (as described above), a competitive Base Salary provided to the CEO in one year might be well below market when compared to a different peer group of larger companies. As a company grows, the need to compete with smaller peers becomes less relevant and the need to compete for talent against larger peers becomes more pronounced. This may require adjustments to executive compensation levels. With this in mind, it is important for companies to take into account the level of growth of their company. In a rapidly changing business environment, the need to review compensation levels on an annual basis is more important to ensure the continued competitiveness of Base Salary and Incentive opportunities against an ever-evolving peer group of companies.

Short-Term Incentive Design

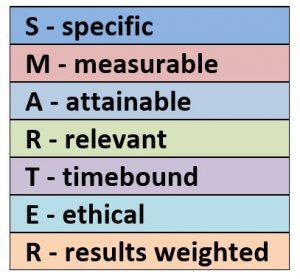

With cash typically at a premium in the early days of a firm, bonuses are traditionally made on a discretionary basis, if paid at all. They might also be provided in one-off situations to secure key talent from a larger competitor or different industry. In either case, there is generally a lack of structure surrounding how bonuses are to be paid on an annual basis. As a company matures, the mix between Salary, Cash Bonus and Long-Term Incentives tends to change with more weight placed on Cash Bonuses, thereby making it more important to place more structure around how bonus payouts are determined. Companies might feel that a Profit Sharing Plan is a good way to structure bonus payouts as many companies use Earnings as one of the key performance metrics to determine cash bonuses. In the cannabis industry, however, accounting rules under International Financial Reporting Standards (IFRS) require companies to value certain inventory on a mark-to-market basis which can greatly impact earnings results, either positively or negatively. This may make earnings less suitable for determining executive performance in a given year. As a result, following the incentive design of a majority of General Industry companies may not be the best way to measure performance. Given many cannabis companies are in a high growth stage, better types of performance metrics might include Revenue Growth, Cash Flow from Operations or specific milestones tied to acquisitions, production levels or Research & Development (R&D). Measuring performance across a variety of metrics (ideally 4 to 5) using a “Balanced Scorecard” design can bring more structure to determining cash bonuses while focusing executives on multiple drivers of future growth for the company. If a company is private and looking to enter the public markets, tying part of their scorecard to achieving their public listing on schedule and at a targeted valuation level can also be considered as well.

Equity Compensation & Related Documentation

The traditional thought process is that any small cap company should conserve as much cash as possible by granting stock options to its executives in order to incent these executives to significantly grow the share price of the company, which will produce wealth for both shareholders and the executives. While this approach makes sense in the early stages of a company, as a company experiences significant growth and investor interest, greater scrutiny is placed on a company’s equity compensation plans. Institutional investors and groups such as ISS and Glass Lewis pay close attention to the level of share dilution allowed under your equity compensation plans. The TSX, for example, limits companies to up to a 10% dilution, while exchanges such as the Nasdaq and TSX Venture Exchange allow up to 20% dilution in certain cases. Those companies graduating to new exchanges should be aware of any changes in the rules governing equity compensation plans as they will greatly impact the allowable room to make future equity grants. No longer can a company run itself with the notion that stock options are “free” as there is a cost associated to them and therefore more structure around how they are granted and who is eligible must be put in place. With the run up in cannabis-related stocks there is also talk of whether a “bubble” is building that is inflating the price of current shares. If the “bubble” were to burst, those executives holding stock options could see the value of their equity fall. Given this possibility, consideration of full value awards such as Restricted Share Units (RSUs) or Performance Share Units (PSUs), that can retain value even in times where share prices may drop, can provide greater retention value for executives in place of stock options. RSUs and PSUs can be less dilutive to equity compensation pools, providing more flexibility to the Board when granting equity to key talent.

Employment Agreements

With the movement from a private to publicly-traded company, or in cases of significant growth and investor interest, greater scrutiny is placed on the employment agreements of your top executives. Shareholders, along with ISS and Glass Lewis, have specific views on severance payments to be made upon a Change of Control of the company (i.e. acquisition of the company) or other termination scenarios. Severance payouts of 3x or 4x eligible compensation (typically Salary Only or Salary + Bonus) were commonly accepted in the past as the cost of doing business. The new acceptable norm is a maximum of 2x for the CEO with multiples of 1x to 1.5x for executives below the CEO, thereby lowering the cost of exiting executives upon a termination scenario. “Single Trigger” Change of Control payments based solely on control of the company changing hands, but not the termination of an executive, have been widely criticized and are being replaced by “Double Trigger” Change of Control provisions – payout is only made to the executive if control of the company changes and they are subsequently terminated from their position within a 12 to 24 month period. Boards of cannabis companies should review the severance provisions being provided to executives under existing employment agreements to ensure they are in-line with new market norms and avoid potential pushback from shareholders.

Shareholder Engagement

Annual General Meetings (AGMs) were considered a “rubber stamp” process for approval of general corporate matters such as the re-election of directors, or executive compensation. In the era of shareholder activism and the rise of proxy advisory firms such as ISS and Glass Lewis, AGMs have become forums to voice disdain, directly challenge executive decision-making, and assert the power of all shareholders to hold a board accountable for its actions. If shareholders’ concerns are not met, they will be heard through the AGM vote. With Majority Voting guidelines becoming more the norm in North America, requiring directors to step off the Board if they fail to receive more than 50% of shareholder votes at the AGM, it is becoming increasingly important for Boards to engage with their top institutional and retail shareholders to gauge their views on issues they deem important. Failure to be proactive increases the embarrassing risk of having one of their directors voted off the board. Boards that fail to embrace the latest in technology solutions dedicated to corporate governance, such as SaaS-based shareholder engagement platforms, deny themselves solutions that can greatly assist the board, executive and Investor Relations team with engagement efforts in an increasingly complex environment. These solutions should be examined as they make the process of engaging with an entire shareholder base much more effective and efficient than the traditional way of doing things.

Proper Due Diligence Maximizes Growth

The past couple of years have provided quite an opportunity for companies across the entire value chain in the cannabis industry due to the relaxation of marijuana laws across North America. While this has led to significant growth for many companies in terms of market cap, the higher amount of investor interest puts more pressure on boards to come up with market competitive compensation packages for its executives that are deemed reasonable by shareholders. By focusing on the key executive compensation issues discussed above, companies across the spectrum of the cannabis industry will be able to confidently defend the process they have followed and the decisions they have made to both shareholders and their executives through their engagement efforts. Opportunity knocks, but without the proper board due diligence the opportunity for growth presented in the current environment can quickly go up in smoke.