5 Trends for Executive Compensation in 2019

USMCA, Cannabis, Energy Sector, Government, Say on Pay All Have an Impact

Several developments over the last year will have an impact on trends in executive compensation for 2019, including the North American Free Trade Agreement (NAFTA) revamp — upgraded to the United StatesMexico-Canada Agreement (USMCA) — increased scrutiny of cannabis companies, “say-on-pay” adoption, and a downturn in the energy sector.

High-sector growth will also drive additional upward pressure on talent and compensation into 2019, which will have a retention impact on the pharmaceutical, fast-moving consumer goods and tech sectors.

Tariffs and USMCA

While the full effect of U.S.-imposed tariffs on aluminum and steel and the new USMCA remain unclear, they could have an impact on how executive compensation is structured for 2019. In late 2018 and early 2019, compensation committees will be working with their advisers and CEO to determine key performance objectives for 2019 for the C-suite. This will include discussions around performance expectations for 2019 to achieve “target,” “threshold” and “superior” performance as part of finalizing the annual performance scorecard used to determine 2019 short-term incentive payouts. With U.S. tariffs and the new trade deal threatening certain Canadian companies, committees are expected to take this threat into account and set performance expectations accordingly. An emphasis on measures such as earnings or revenue may be lowered, with more put on maintaining market share, developing new markets for products or cost-cutting measures to deal with trade concerns.

Cannabis Sector

2018 has seen the continued rise in share prices of cannabis companies, leading up to the legalization of recreational cannabis use as of Oct. 17. Many of these employers have witnessed such rapid growth that their compensation programs have been unable to keep up. They have been playing catch-up by trying to implement more formalized compensation structures for executives and staff. This has forced companies to review the dilution of current equity incentive plans (for many companies, stock options only) which have been highly diluted by equity grants made to attract key executives and staff at much lower share prices. This means current equity pools have little room left to make future grants for new hires heading into 2019. Companies are forced to review who has and has not received equity grants in the past year, and also the share price these grants were made at, to determine who is in most need of a grant to keep them engaged, as well as allow for the equity pool to eventually be replenished and provide the right pay-for-performance balance.

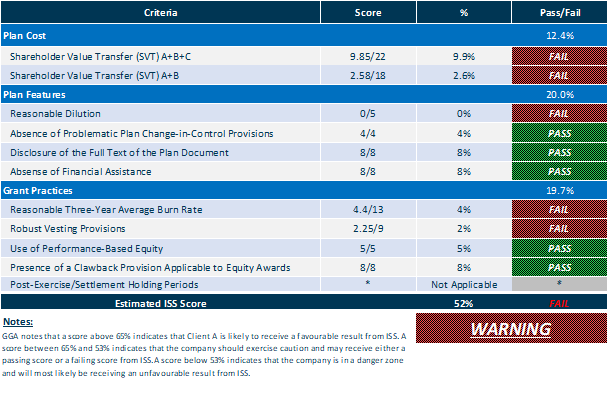

Aside from the cannabis sector, it’s expected companies across Canada (especially small- to mid-cap companies) will review the dilution level in current equity plans when developing 2019 recommendations. For companies looking for shareholder approval of equity plans at the annual general meeting in 2019, conducting this review against Institutional Shareholder Services (ISS) and Glass Lewis guidelines will be imperative to ensure they receive positive vote recommendations and have their plans approved. In addition to equity plans, more structure is expected through the development of balanced scorecards identifying five to seven key corporate and individual performance measures for 2019 to be put in place for cannabis companies to measure 2019 performance and determine 2019 short-term incentive payouts at the end of the year. This trend is expected to grow in prevalence across Canada for all industries as ISS, Glass Lewis and shareholders demand more rigor and structure be put in place to align executive pay with performance — both on an annual and long-term basis.

Downturn in energy sector

The Canadian energy sector has witnessed another downturn in share prices, especially in the energy equipment and services industry. In 2019, energy companies are expected to review executive compensation levels and determine whether downward adjustments (similar to earlier this decade) are required to send a message to shareholders that executives are feeling the pain, too. Companies are expected to review whether short-term incentives should be paid for 2018 at all, or whether deferral into a long-term incentive grant to preserve liquidity for the business and tie executives more to the company’s long-term performance makes more sense. Employers will also face dilution concerns due to lower share prices, so they need to be diligent in ensuring they do not overly dilute their equity pools and restrict their ability to make grants in future years. Focus on the retention of critical talent and high-potentials will be imperative in 2019.

Government intervention

Government scrutiny of executive compensation has received much attention in recent years. During 2018, the Doug Ford government in Ontario rallied against executive compensation at Hydro One which led to the removal of many executives and board members. In Alberta, the NDP government has also shown a willingness to intervene to control executive compensation at universities, colleges, agencies, boards and commissions. With less than one year before an election, will the NDP government implement more rules on executive compensation in Alberta? And will Ford look to intervene in other quasi-public sector organizations? Only time will tell.

Say-on-pay adoption

Say-on-pay failures continued in 2018 with Crescent Point Energy, IMAX and Maxar Technologies each receiving less than 50 per cent approval. While say-on-pay adoption has stagnated of late, the recent announcement by Alimentation Couche-Tard that a say-on-pay vote will be held at its 2019 annual meeting sparked hope that other companies will follow. In looking at Canada’s top 100 companies, close to 30 have yet to adopt such a vote, according to Global Governance Advisors, including corporate titans such as Power Corporation of Canada, Rogers Communications, Canadian Tire and Loblaw.

Will Alimentation Couche-Tard’s decision influence these companies or will these companies continue to lag behind other large companies in Canada? With all these developments, companies are rethinking the structure of their executive compensation programs in terms of the type of compensation offered and metrics used to measure performance. And with the changing economic outlook, they are also determining how to best attract and retain the key talent needed to successfully handle the new reality.

Paul Gryglewicz is a senior partner and Peter Landers is a partner at Global Governance Advisors in Toronto, a human capital management firm providing boards of directors and senior management teams with advisory and technology solutions. For more information, visit www.ggainc.com.